|

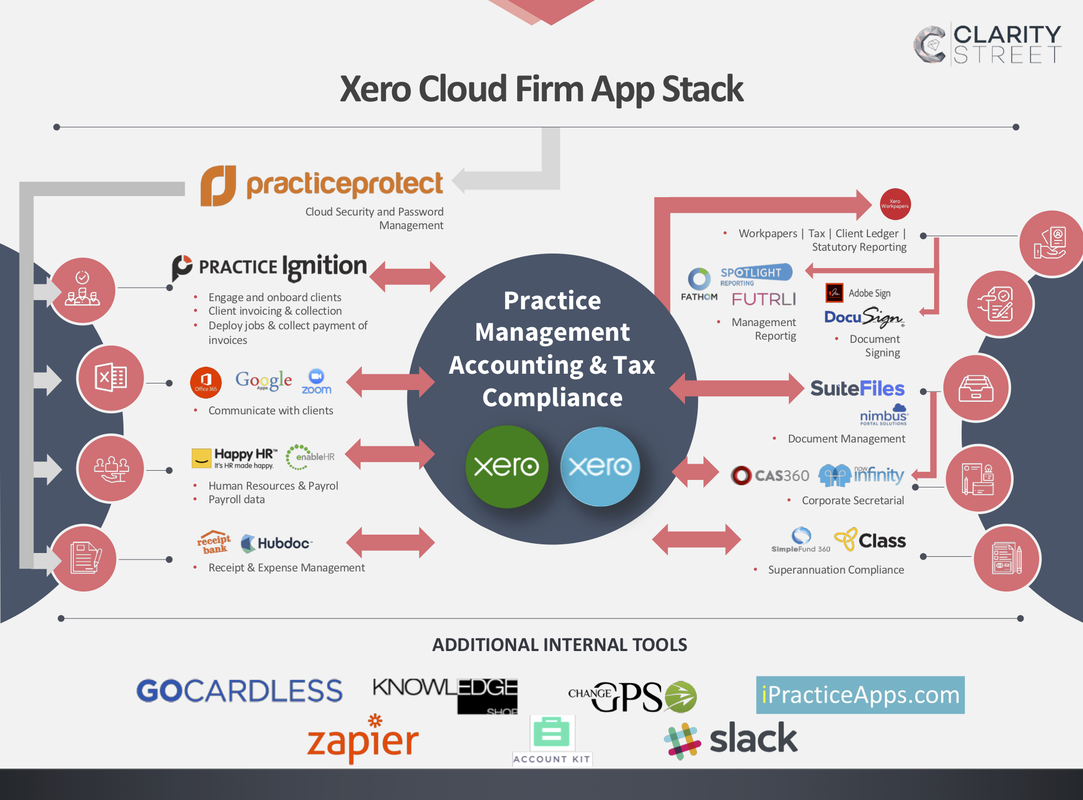

It’s time to wrap up our app stack! Thank you for your continued reading of our App Stack series and we hope that you’ve gained some knowledge and insights into the applications that we recommend. These apps are enablers to the running of any business, in particular and accounting and bookkeeping firm. Our final blog in the series is discussing the additional applications that are not core, but can help streamline your business or firm. They perform various functions that might otherwise have been performed by a spreadsheet or some form of manual system. As some of you may have noticed we’ve had a rejig of our app stack to accommodate new awesome applications and unfortunately drop off some applications. We obviously want to stay at the forefront of the most robust and efficient cloud accounting applications and we too from time to time need to change what we recommend to our clients. We have now added in ATO Smart Docs and Go Cardless into our App Stack. CommonLedger has been removed, they are now no longer able to provide their original service of syncing desktop and cloud files to practices Xero ledger files, due to restrictions on the Xero API. Zapier

Zapier is the tool that brings everything together when apps don’t talk natively to each other. Instead of apps trying to integrate with every other app they use a third party application such as Zapier that can “zap” information between the two applications. This allows apps to scale quickly as they do not have to natively build or support every application interface they just have to build an integration with Zapier and let them do the rest! We love Zapier at Clarity Street as it fills in the gaps! It’s a bit like silicon in the building industry! Our friends at Practice Ignition have already written a comprehensive blog on this so we do not want to reinvent the wheel so we will keep our summary brief. In our App Stack Zapier can be used to talk with Slack, which is one of our communication apps. Where we find this is useful notifying the team of a win, accepted proposal. This is done by creating a channel to house the notifications eg #piproposalswon and then having a trigger of a celebratory champagne popping giphy and the client and their proposal id. This will do two things, 1 it will highlight to the whole team that you have just won a proposal which means that they will be paid next week and 2 it allows for those who may not have been involved in the process to see what the proposal of work was and what is expected to be completed and by who. Account Kit Where do we start with Account Kit? I think the best summarisation is from Paul Murray himself, "Account Kit is the sand that fills the gaps left by other line of business accounting applications". We are biased at Clarity Street as Ian actually had a similar idea back when he was working for Interactive Accounting, and inspired by a "lightly inebriated" conversation with Guy Pearson, went out and registered a company called Accountants Toolbox, that was to provide tools to accountants that had not yet been "cloudified". Unfortunately or fortunately for Ian, the company never got passed a dodgy website (that is now defunct!) and the idea faded away into his next idea, recycling wine and beer bottles, and turning them into useful items at Second Life Bottles. Now back to why Account Kit is a recommended app of Clarity Street, other than nostalgia, Account Kit is built by accountants for accountants and provides accountants with tools that no one else is building in the cloud. A great example of of what they do is their CHP calculator which not only produces the loan schedule, but it also integrates with xero and pushes across the appropriate journal entries on inception of the CHP, and then on a monthly or manual basis. This would easily save accountants 10 minutes per CHP every year. So if you have a client with 3 CHP’s, that’s roughly a $50 saving based on 30 minutes at an average graduate charge out rate of $100. They also have a very nifty (yes nifty!) loan reconciliation tool, that allows you to compare two seperate Xero files and their associated loan accounts and identify, correct and add entries to either file bringing them back into line. Another feature that accountants using our App Stack will love is the seamless integrations with Xero Practice Manager, Xero Blue, Slack, Suitefiles and Now Infinity, bringing even further automation to your firm. Account Kit has a whole bunch of other features and they can be found here. If your firm is looking for "the sand that fills the gaps" then check them out, you won’t be disappointed! Change GPS Like AccountKit, ChangeGPS is built by Accountants, for accountants. They’ve built a platform that literally simplifies the entire client advice process and experience. It’s modern, has easy to use systems and client friendly documents, so you (the trusted advisor!) can focus on "facetime" with your clients rather than having to create documents when your team need them. You can have everyone in your accounting business using the same systems and documents from the one central source for quality and efficiency. If you're leaving a big accounting business to start your own or just need to update your internal content for an established firm, ChangeGPS provides an instant set of proven systems and documents to immediately use. It also has some ridiculously cool features regarding marketing and client services segmentation, which allows you to really understand the cross section of your client base and areas for improvement and growth. We have some BIG LOVE for the team and product of ChangeGPS, it has a place in every firm. Knowledge Shop If you are looking for a tax resource and don’t want to pay big $$’s for a tax lawyer every time, then Knowledge Shop is your answer. They offer tax advice, backed by Hayes Knight, as part of their monthly fee, you also receive resources such as a monthly newsletter to send to clients, internal templates etc but they also offer professional development training which is fantastic for firms that are looking for ways to keep up their PD. Knowledge shop is a well priced resource for your firm, that will pay for itself in tax advice alone, especially for those smaller firms who may not have the internal resources available. Go Cardless If you are looking for a direct debit option for your firm and you have not implemented Practice Ignition, first we will ask why not, second we will recommend the team at Go Cardless. *Disclaimer* we may have “acquired” a bomber jacket from Go Cardless at Accountech.Live but I promise we were recommending them well before this! #lovefreemerchandise When we first came across Go Cardless we didn’t think it had a place as there was Stripe, but then we realised that Go Cardless offers functionality that Stripe is not the best at providing, recurring direct debits! Go Cardless is not only a solution for accounting and bookkeeping firms, but it’s also a solution for their clients who may be struggling with their debtors. It offers an integration with Xero that allows the customer to pay directly from the invoice. Currently the integration only allows for the full amount of the invoice to be directly debited however, we have been assured that partial payments it not far off and when this feature is available it will be a complete direct debit system for you and your clients! They also cap their fees at 1% or $3.50 per transaction, whichever is the lower. For accounting and bookkeeping firms there is a partner program that provides you with training to make sure that your clients receive an exceptional setup from you and also some financial incentives! Go Cardless is a perfect solution for a firm who is looking to integrate Xero and direct debits at a low cost. ATO SmartDocs Ron Drost has done it again with ATO Smart Docs, literally, he has recreated the paperbuster desktop application in the cloud, with further enhancements including an API which allows it to sync with other cloud based applications, opening it up to a whole new world! Why do we think that ATO Smart Docs is a great addition to your firm you ask? Well that is pretty simple, Clarity Street believes that any application that can enhance or reduce the burden on the administration function of a firm, is a good investment and ATO Smart Docs clearly ticks that box! They have done their research and the research suggest that on average it takes 6 minutes to check, compile and send a Notice of Assessment (NOA) however, with ATO Smart Docs it takes less than 5 seconds! This leaves the administrative support staff with a further 5 minutes and 55 seconds to provide value to your firm in another manner. ATO Smart Docs also realised that most people now spend more time on their smart phones than they do at a computer or checking the mailbox, therefore they’ve built a native portal that is accessible on a mobile device to further enhance the delivery of client documentation. We think that it’s a no brainer to stop spending time creating correspondence that can be automated using ATO Smart Docs! In summary the above applications are not line of business or core applications of an accounting or bookkeeping firm however, when they are implemented they are designed to serve as an additional efficiency to what may be currently a manual or non existent task within the firm. We hope that you have enjoyed our App Stack blog series and we look forward to providing updates on these blogs when new and exciting features become available. As always if you are looking for help implementing any of these applications or any of our featured app stack, please contact us for a no obligation chat about how we can bring clarity to your firm! 7/6/2020 11:37:13 pm

Devouring these posts pending the design and implementation of our own app stack - exciting times! Comments are closed.

|

AuthorClarity Street was conceived from years of engaging with Accounting firms on a daily basis and a constant desire to make Accounting firms & SME’s more efficient and profitable. Archives

July 2024

|

RSS Feed

RSS Feed