|

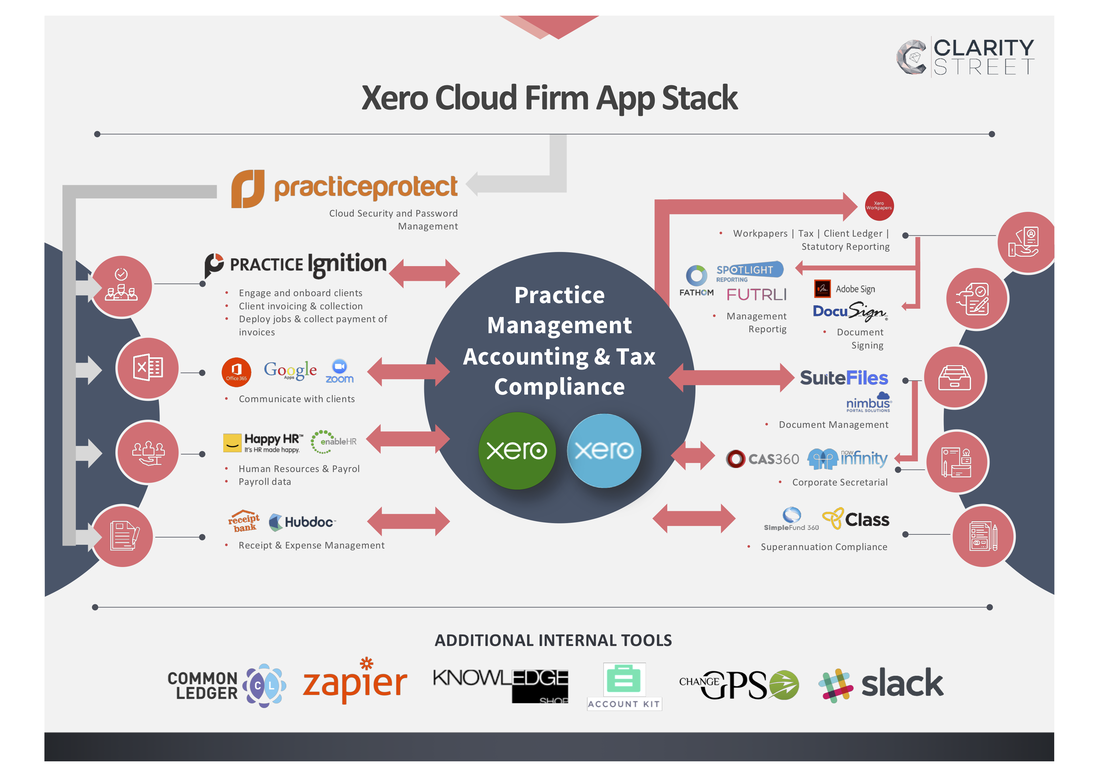

Last week we left you with a visual teaser of our currently preferred App Stack for an accounting firm, which we hope you found insightful. This week we go a little further in depth into some of the applications that are mentioned. We start off with the four core products that drive an efficient Xero based firm, as they allow an integrated, end to end solution for the client lifecycle. Just for the record, we know there are still some idiosyncrasies and potential enhancements required with some of these platforms, and although the software stack could fit most firms, they may not fit every firm’s choice or internal operation. Just remember, when approaching considerations about particular apps etc, don’t over engineer what you are trying to archive, remember this is about an efficient client life cycle process. Below are listed some of the individual characteristics of the four key software applications. By using these integrated software platforms, and then adopting changes to your processes, you can achieve a streamlined internal workflow solution. First out the core products is Practice Protect. Practice Protect Practice Protect is the first application that we set up! It provides an easy way to manage passwords, control access and protect data online. It’s designed especially for Accountants to help them better protect and control their cloud applications, protecting over 5000 common applications. Practice Protect also help firms secure their business by providing training, legal compliance documentation and a Cloud Best Practice certification program. It’s key features are:

Once you’ve set up Practice Protect and logged in, if we were to follow the client lifecycle, Practice Ignition is actually really the first app you would use in the client lifecycle, here’s why. Practice Ignition (PI)

This is where the client journey begins. You have the initial meeting with the client and then the conversation usually ends with the client saying something like, “so what are you going to do for me” and “how do I become a client of yours?” This is where Practice Ignition takes all the pain away, by providing a seamless journey for the client covering:

Now, as a Xero based based firm, if you’ve engaged your client correctly and linked this correctly, your next key App in the client lifecycle is Xero Practice Manager. This is where you would manage your workflow and with Xero Tax, create the relevant compliance returns. Xero Practice Manager (XPM) & Xero Tax Now it’s important to remember a few things about Xero Practice Manager and that some of the misconceptions in the industry around XPM, are in relation to the functionality it offers. It’s true that it doesn’t have all the bells and whistles of other products out there, but having said that, it does EXACTLY what it needs to do and if that is kept front of mind, adopting the software will be a much easier process. Here’s what it does really well and therefor what it needs to do to manage your practice:

Finally and obviously, you need Xero also, here’s why: Xero (Blue) Xero is a central cog in our application stack as it is where you will not only manage your own internal accounts but this is also where you will manage your clients general ledgers, be that on a once a year basis when preparing their Financial Statements or on a daily, weekly, monthly, quarterly basis etc. Xero is used not only to produce a general ledger but it is then able to be linked into other parts of our app stack for example workpapers, reporting and tax creating a seamless environment and much less friction.

As you can see, after logging in securely through Practice Protect, utilising the three core apps (Practice Ignition, Xero Practice Manager & Tax and Xero) in conjunction with each other, will provide you and your clients with a seamless client lifecycle. Next week, we discuss the additional apps used that form the basis for your additional services and business advisory that you offer to your clients, obviously these connect with our core apps! If you want to know more in the meantime, get in touch!

This was a great excellent informative post you have shared in the above article about the havent paid article but the invoice can be an awkward situation. Rather than having to call or email directly, you can use a simple reminder tool in PayPal to do it for you. The message is automated and, for some clients, the gentle non-personal nudge can get you paid sooner. Comments are closed.

|

AuthorClarity Street was conceived from years of engaging with Accounting firms on a daily basis and a constant desire to make Accounting firms & SME’s more efficient and profitable. Archives

July 2024

|

RSS Feed

RSS Feed