|

In today’s hyper-competitive world, accounting practices are looking to leverage new technology to digitize inefficient processes to reduce cost AND streamlines processes AND improve client experience. But, what if the other “AND” included revenue uplift for your practice? "Our firm has also adopted Audit Safe which has lowered the administrative burden and increased income when compared to the traditional tax cost recovery audit insurance." - Tom Carr Partner. Oreon Partners Who is Apxium and what is Audit Safe? Apxium develops purpose built solutions for accountants to solve their most complex pain points around manual processes and collecting payments. One pain point we all know too well is the arduous process around how accounting practices sell tax audit insurance to their clients. Let’s break it down:

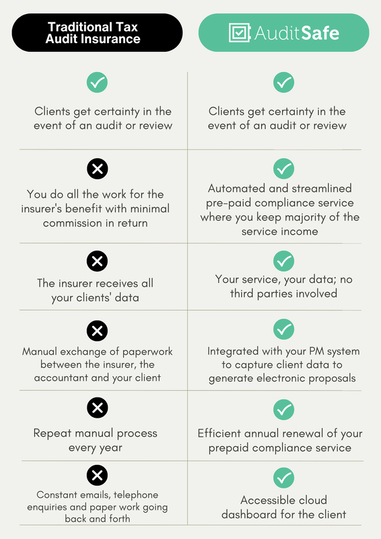

Apxium has worked with accounting practices to truly understand the myriad of existing challenges behind selling tax audit insurance. As part of this process, Apxium engaged with ASIC to ensure Audit Safe is compliant with the Australian Financial Regulatory framework, whilst collaborating with accounting practices to ensure it is fit for purpose. Today, Audit Safe is used by accounting practices across Australia. The feedback has been so positive that Apxium recently launched a similar solution in the U.K. Audit Safe Vs Traditional Tax Audit Insurance Let’s start with what Audit Safe is not; it’s NOT an insurance product. But, it certainly achieves the exact same protection for the practice's clients through a carefully crafted innovation and a few clever subtleties. Without going into too much technical detail, Audit Safe flips the insurance game on its head by empowering practices to deliver a “prepaid compliance service” that completely replaces traditional tax audit insurance. What does this mean for your practice: As your clients’ trusted advisor, it’s always you who will complete the work in the event that they face an audit or ATO review. By paying for the prepaid compliance service, your client has certainty that you will complete the work up to the agreed limit with no further cost to them. So, let’s break down the benefits of Audit Safe:

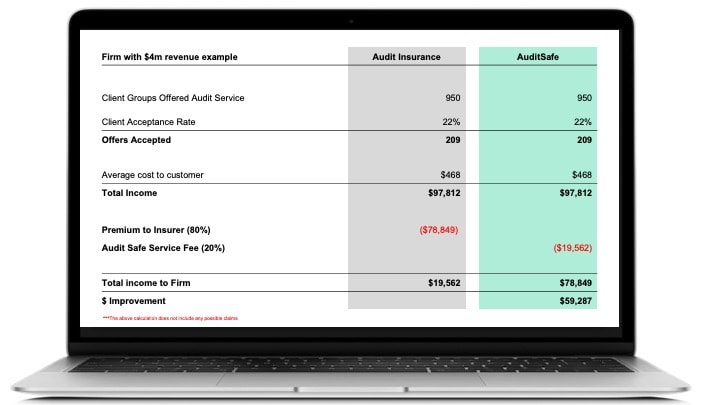

AND, there you have it; Audit Safe also generates a new income stream for your practice. Image: Tax Audit Insurance Vs Audit Safe How does the tech work? As a simple, cloud-based plug-and-play solution equipped with a payment gateway, Audit Safe hooks into your Practice Management Software to perform the following: ✅ Automatically captures your client data into a cloud dashboard for you prepare offers/proposals ✅ Differentially price the prepaid compliance fee, given you know the risk of your clients better than anyone else ✅ Generates and sends proposals to your clients with payment links ✅ Collects the compliance prepayment fee AND takes care of all the client receipting AND reconciliations ✅ The Audit Safe system rolls over all of the previous year’s offers ready for you to send them again, making any changes super easy to deal with 4-6x more income to the accounting firm On average, practices generate 4-6x more income with Audit Safe than selling tax audit insurance. If we look at some quick calculations when comparing Audit Safe Vs Insurance, the following scenarios reveal how one particular practice made an additional $59,287. In our first year of using Audit Safe we have dramatically increased our income, streamlined a previously difficult administration process and our clients continue to have certainty in case of regulatory audits and reviews " - Rebecca Rodighiero, Practice Manager at Oreon Partners The experience your clients have with Audit Safe

Most importantly, your clients achieve the same level of protection to respond to an ATO enquiry, but with the bonus of no claims process for you to deal with! From the technology and client experience perspective, Audit Safe provides you and your clients with a modern cloud experience. This means that the complete proposal acceptance process occurs online, where clients get their very own self-service portal. Through this portal, your clients can view all accepted (and unaccepted) proposals, payment history, receipts/statements etc. They no longer need to call and email to enquire about their proposal or payment status, and they can even change their payment method any time. If you're interested in trying out Audit Safe, request a demo here. We're hosting a webinar with Apxium later this month, so keep an eye out on our socials for more details! If you'd like to find out more about how Audit Safe could benefit your accounting firm, get in touch with us, or book a meeting here. Comments are closed.

|

AuthorClarity Street was conceived from years of engaging with Accounting firms on a daily basis and a constant desire to make Accounting firms & SME’s more efficient and profitable. Archives

July 2024

|

RSS Feed

RSS Feed