|

There's been a bit of confusion in the industry about Clarity Street and if we have pivoted to being an advisory app and changed our name... Short answer is no, but we do LOVE Clarity HQ, not just for their awesome choice in name (secretly we’re pitching for cobranding as Clarity2!!), but because the application actually solves a massive problem right now in the industry.

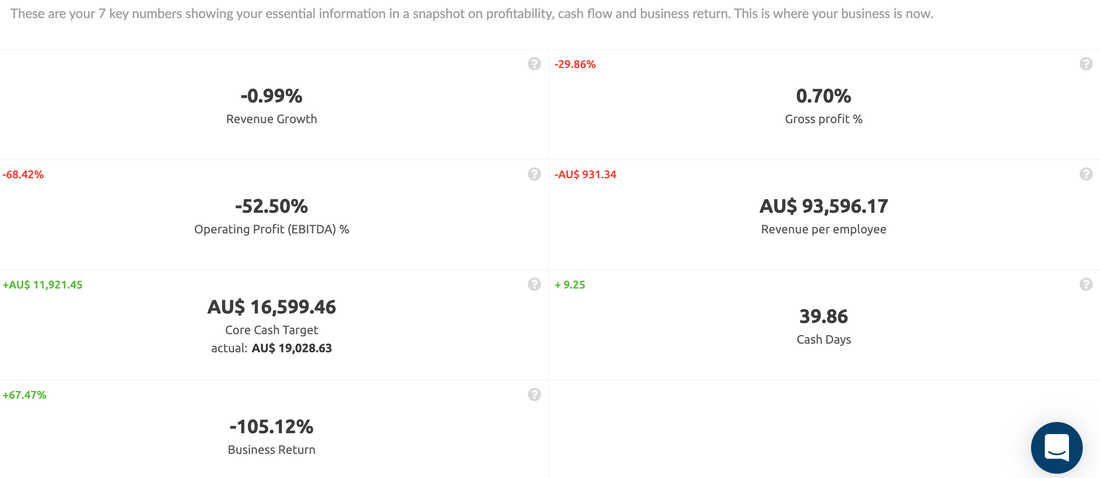

Clarity HQ are the new kids on the block–chain when it comes to advisory services, or should I say “pre advisory” services providing advisors with real time information, around 7 key metrics of a client's business, creating trackable action plans, storing client internal business documents and most importantly providing education to the advisor about what business advisory actually is, in the context of their 7 key metrics.

Why is it a part of our app stack?

Apart from the awesome name, the main reason we have included Clarity HQ into our app stack is because it solves the very real problem for accountants of “how do I start the conversation with my client around advisory services”. One of Clarity Streets mantra’s is to leverage technology to provide people effectiveness and Clarity HQ lives into this by providing a technology platform that makes the first steps to advisory simple. The app was built with mobile first in mind and therefore natively you can view every screen on a mobile device and it will scale to the best fit, we think this is a great way to address the ever increasing default way that data is viewed and consumed by accounting clients. Currently the platform integrates with Xero and Quickbooks Online, and it also has a manual entry function (because accountants lived in excel before the clouds!). The app integrations mean that the data is kept upto date in real time allowing the advisor to hit refresh and have the very real conversations with their clients. It also uses blockchain technology for its document storage verification inside of the client’s data room, more on this below. What does it do? Clarity HQ is the first step before you jump into offering full advisory services to your clients. It helps you to quickly identify areas of concern or improvement from a client’s accounting file or excel upload. For the best results it would be advisable to actually run your eye over the bookkeeping before relying on the information, as we all know the saying “crap in crap out”. It uses 7 Key Metrics, explained below, to quickly give the advisor some high level talking points with their clients.

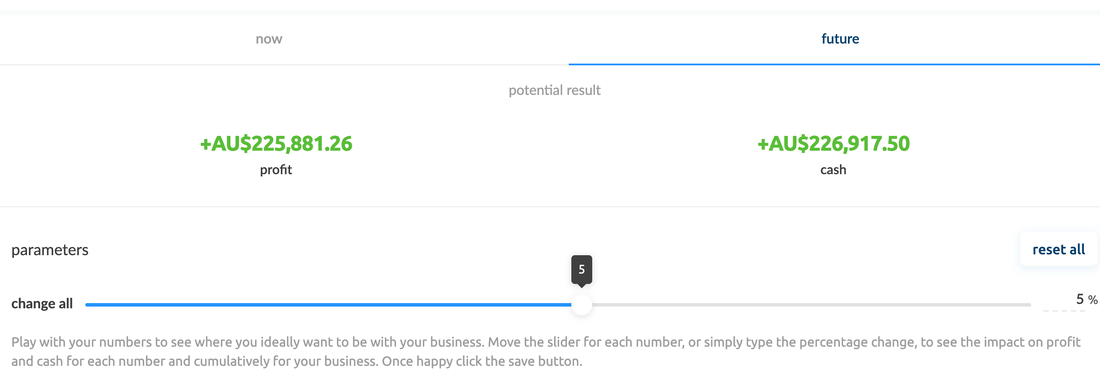

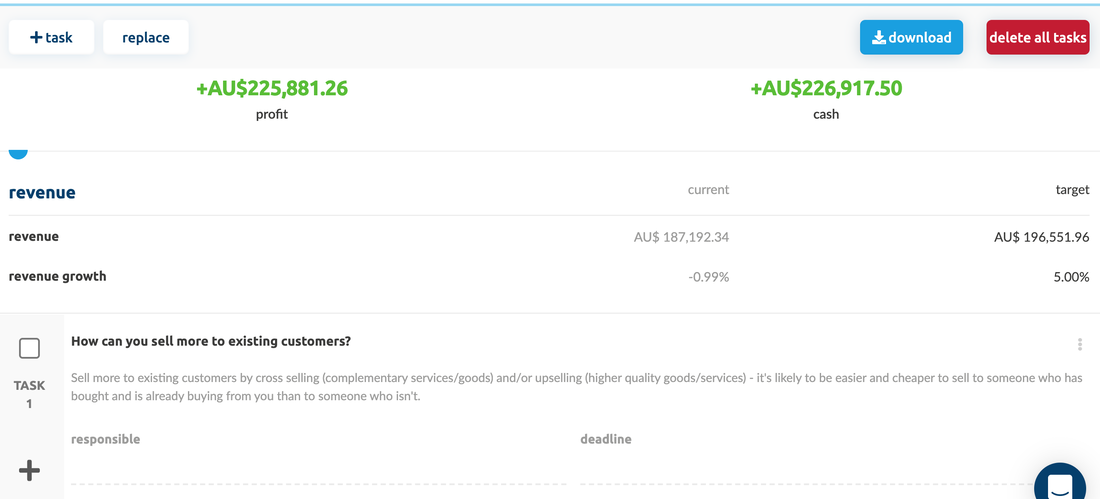

A real shining light here is that all of the above metrics can be quickly manipulated to show best and worst case scenarios, either individually or at a master level.

Off the back of the targets you’re able to produce an action plan for your client, including tasks, responsibilities and due dates, on how you might achieve the nominated growth targets and collaborate with them on each of the targets. At the moment you can only have one action plan at a time and there aren’t any smarts or AI built into this piece however, we can foresee in the future that if Clarity HQ identifies a piece of advisory, it will tailor the advice that the accountant is providing and therefore no two conversations will be the same with clients.

Is this not like all the other reporting apps in the market place?

Short answer is no. Clarity HQ are clearly positioning themselves to be the link in the chain before an advisor offers a full complement of advisory services to their client. What we mean by this is that the conversations had off the back of a Clarity HQ action plan would involve things like a 3 way forecast or cashflow budgets, these are not services that Clarity HQ offer. We suspect in the future there would be embedded links in the action plan to other reporting applications such as Fathom, Spotlight, Float etc. Who knows this may even be off the back of the new Xero ecosystem changes with Xero’s single sign on functionality and being able to register for a demo of the reporting app. Clarity HQ is not only trying to solve the conversation piece around business advisory but provide some real knowledge for the accountant around the metrics it provides and the conversations that can be had via their business university and soon to be released advisor university. We mentioned blockchain earlier and no, Clarity HQ is not going to ask for payment in Bitcoin, or atleast not yet! Clarity HQ utilises the Ethereum blockchain to verify documents that are uploaded to their data centre. What is the data centre you ask? The data centre is a place for the client to store all of its internal business documents, for example their strategic plan, brand & culture, finance, systems etc. This is particularly relevant to any clients that are embarking on a funding round and who need to invite investors into a data centre to view all of the due diligence carried out on the business. No more back and forth with lawyers and sharepoint, all the documents are sitting in the client's data centre, verified and ready for inspection! And don’t panic, all your data is safe and secure in Amazon Web Services AWS, (the same way Xero store your data), it’s just the time stamp that goes on the document from blockchain for the verification process. That is just one of the scenarios that could play out using this technology. That's a wrap Clarity HQ is only in its infancy and if what they have achieved so far is anything to go by, their future is going to be a very bright one! If they can continue to improve their business university and roll out the much anticipated advisor university, we certainly think they will be a pivotal part of your advisory toolkit! Comments are closed.

|

AuthorClarity Street was conceived from years of engaging with Accounting firms on a daily basis and a constant desire to make Accounting firms & SME’s more efficient and profitable. Archives

July 2024

|

RSS Feed

RSS Feed