|

DiviPay are here and making a splash in the spend / expense management space of the bookkeeping and accounting world. DiviPay is a Sydney based FinTech app that allows business owners and finance teams to implement flexible financial control over employees at the point of spend. Corporate card spend, bill payment spend, subscription management. When a business spends money, it happens in DiviPay and then magically all of the data will flow through to a DiviPay bank feed before seamlessly pushing into your accounting software. DiviPay’s core product is a virtual corporate card that you can setup for your entire firm in a matter of seconds. It allows your team to spend money on business expenses from their own mobile device. Spending specifically from a bespoke budget that you’ve created and put in place. Think about every time you lend your credit card to a team member to pay for ASIC fees, or get coffee, or take clients out for lunch. Let me pose a few questions to you, to help get you in the frame of mind of where DiviPay becomes the right solution for your firm or one of your business clients:

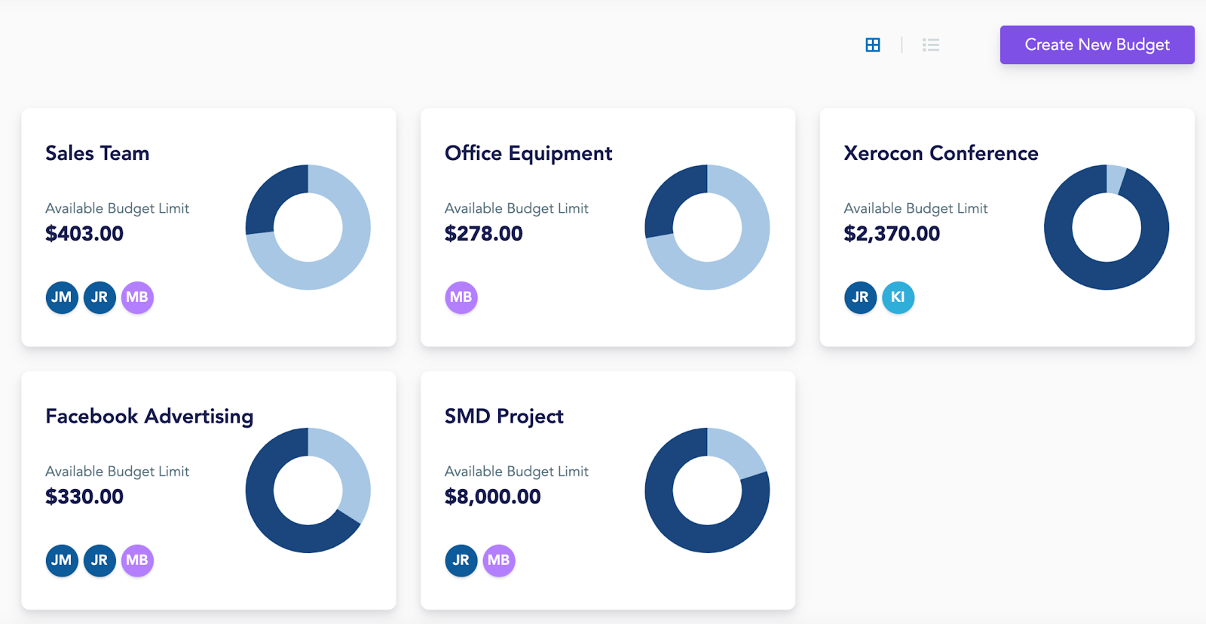

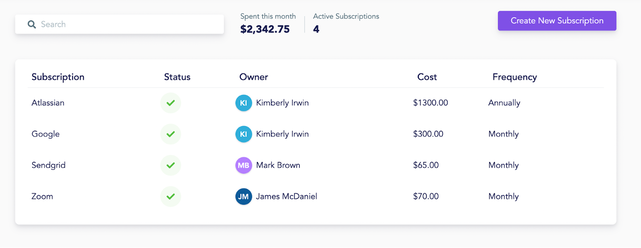

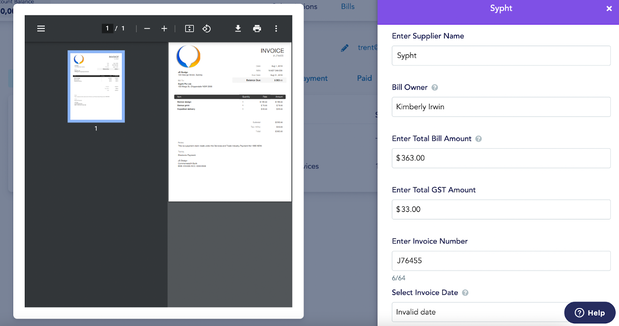

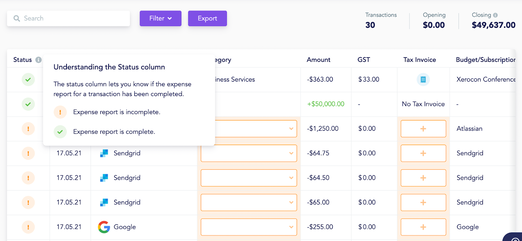

DiviPay was inspired by these core problems that small to mid sized businesses face every single day! Whilst some of the pain may feel surface level, the friction is very real for your team. Financial bottlenecks are never fun however we understand they're necessary, we're on a mission to streamline and help improve these financial controls through innovative technology with a few examples below: Smart Digital Corporate (Mastercards) Cards: Issue multiple digital corporate cards to your team in seconds allowing them to pay for expenses using Google Pay / Apple Pay and are then prompted to take a receipt and upload it directly within the app. Budgets that your team can access: Create multiple budgets that your team can access and draw down from. Subscription Management: Create multiple digital mastercards for all the subscription services in your business. Automated EFT Bill Payment & Approvals workflow: Provide suppliers with a dedicated email address to send their invoices (bills) too. The OCR technology will process the information, create a bill and push it into your accounting software. From here you can create an approvals workflow to ensure all the right checks are put in place BUT as part of that workflow you can also let DiviPay pay the invoice, directly from your DiviPay account - AUTOMATICALLY! Transactional Data at your fingertips: Whether you're a bookkeeper, accountant or the owner of the business, you'll love being able to eyeball every single transaction and money that's coming in and out. DiviPay has an Accounting & Bookkeeping partner program designed to help engage and enable firms to support their clients with the setup of their DiviPay account & subscription.

DiviPay integrates with Xero, MYOB & QuickBooks seamlessly. We also have great example of businesses that use DiviPay not connected to a ledger where their month end process was reduced from 3 days to 2 hours. So ledger or not, DiviPay is extremely effective. DiviPay starts at $6 per user, per month. Works on both iPhone and Android. If you’re keen to see how it works you can start a free 14-day trial and begin our application process. If you have a question in relation to DiviPay and how it could work on your current App Stack, get in touch with us! Comments are closed.

|

AuthorClarity Street was conceived from years of engaging with Accounting firms on a daily basis and a constant desire to make Accounting firms & SME’s more efficient and profitable. Archives

July 2024

|

RSS Feed

RSS Feed