|

You know your CRM should be your single source of truth. But is it? Really? How do you know? Have you ever checked it against ASIC or the ATO? Recently? With a significant number of accounting firms based around Xero Practice Manager (XPM), the importance of getting it right in set-up and content cannot be underestimated. With firms plugging into XPM the likes of FYI, Suitefiles, Practice Ignition, Xero, Link Reporting, Etani and so on, the importance of correct data is, quite simply, the backbone of your firm.

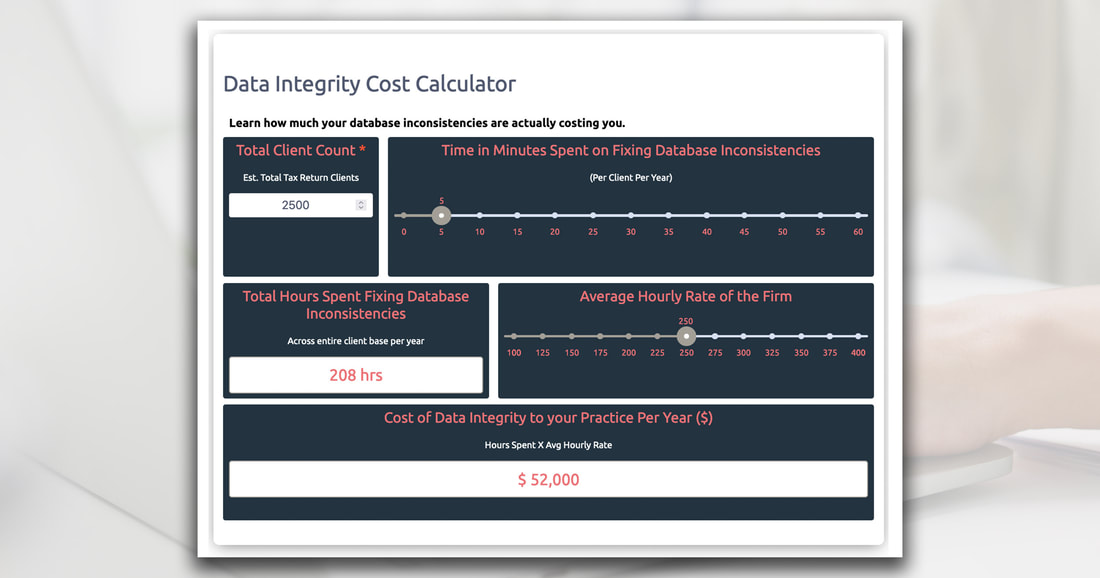

Most firms believe that their client list is correct, but have never conducted a reconciliation between XPM and ATO, or XPM and ASIC. In our experience there is an industry reconciliation error between XPM and the ATO that starts at around 15% up to 40%, meaning between 15% and 40% of your client list you think your need to work on - is wrong. You, and everyone, will immediately react and think, mine’s fine, I don’t have to worry about it as the admin team has it covered - and they might. But do they know that you can upload the ATO report direct into XPM to update all the ATO details and dates? Do they do this on a regular basis? Have their completed a recent reconciliation between the two to see what doesn’t match? Have they done the same with your companies in XPM versus ASIC? Accountants get caught out because they were unaware that their client’s tax return due date had been brought forward, lodge it late and subsequently effect’s their lodgement percentage. We know numerous firms get caught out trying to lodge returns for clients that have been removed from their portal. All of these types of issues cost money. Having worked with a lot of accounting firms, our experience has taught us, that data integrity is currently an issue, and it’s costing each accounting firm a lot of money. How much money? For Example: Total Client Count: 1000 Data Integrity issue per client: 5 minutes (per year) Total Hours of Data Integrity issues: 83 hours*200 Hourly Rate: $200 ph Total Cost of data integrity p/a: $16,666.67 This figure doesn’t speak to inefficiencies in processes or systems, this is only a very basic starting point of “the data is wrong”, not what you’re even doing with the data. To that end, Clarity Street has developed an XPM integrity check tool that provides a starting point to give you a snapshot of what the current situation is with your XPM. At Clarity Street, we look at the major components of your XPM for it's data integrity including, missing Account Managers, Tax Agents, Group Codes, Due Dates, Date of Birth, Active ATO, Prepare Tax Returns, Prepare Activity Statements, Client Codes, and so on. It’s designed to start the journey and conversation on what needs to be done with your specific XPM. If you have the extra $15K to $20K to throw away on bad data, our tool is probably not for you. If you'd prefer to save those dollars, it’s probably time to have a look into the accuracy of your data. More details on how this service could help your accounting firm here. Comments are closed.

|

AuthorClarity Street was conceived from years of engaging with Accounting firms on a daily basis and a constant desire to make Accounting firms & SME’s more efficient and profitable. Archives

July 2024

|

RSS Feed

RSS Feed