Strengthening Client Relationships: The Crucial Role of Communication in the Accounting Industry28/9/2023

We have heard that in the accounting industry there is often a disconnect with client communication.

As an accountant, part of the services that you provide is communication with your clients. This may be communication about the ways they will need to access data and information you send to them. Communication about moving your firm to upfront pricing, due to engaging a new piece of software like Ignition. Communication about having to use two-factor authentication going forward, or as a matter of fact, any type of changes that are made within your business. "The most common obstacle faced by the numerous firms we’ve worked with is the absence of a software and process-centric learning and community platform."

An excerpt from XU Magazine xumagazine.com | September 2023 | Full publication here In the dynamic landscape of accounting, it's not enough to just crunch numbers. More than ever, clients need trusted advisors who can bring fresh perspectives to their long-standing challenges, envisioning and achieving unlimited possibilities. One such challenge that often goes overlooked is managing renewals.

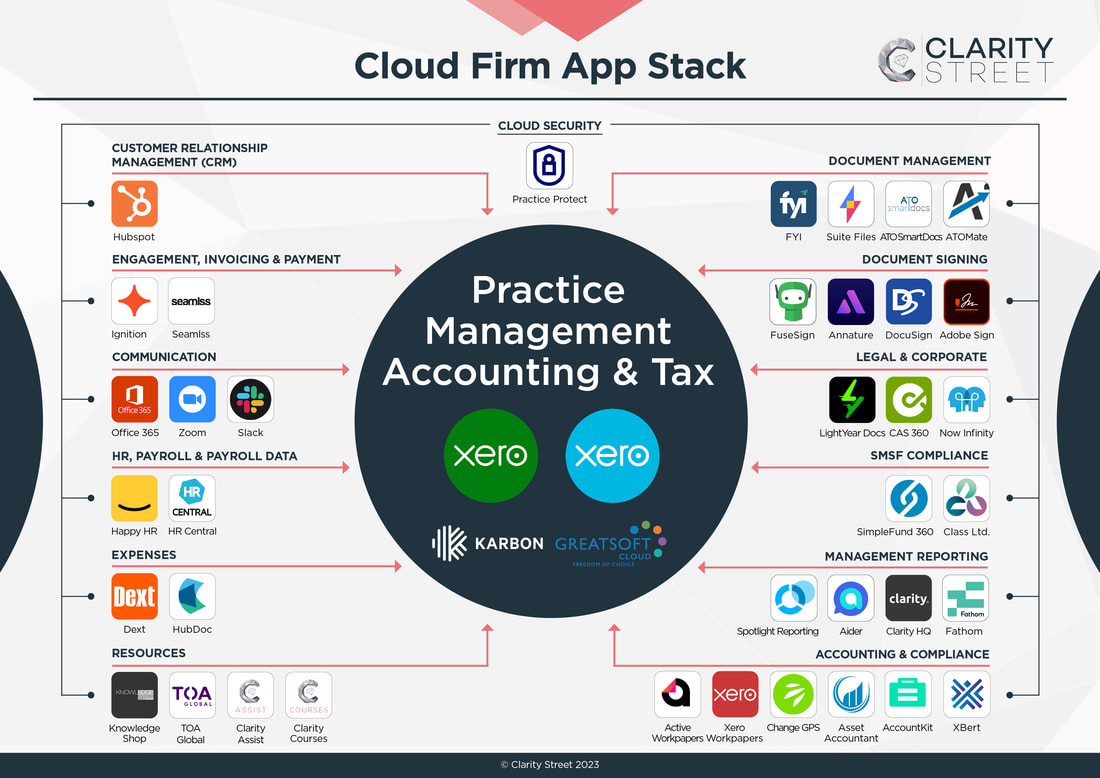

At Clarity Street, we strive for a best practice approach to practice, and as such, we do our best to keep up to date with all of the latest applications, adjusting our App Stack accordingly.

Our latest App Stack comes with a new addition that revolutionises practice management in your accounting firm. More details below! As businesses have grown, they've adopted various digital solutions to tackle specific tasks. However, many of these solutions are specialised, designed to solve only one problem, leaving manual work like data entry and consolidation still necessary to transfer information between systems.

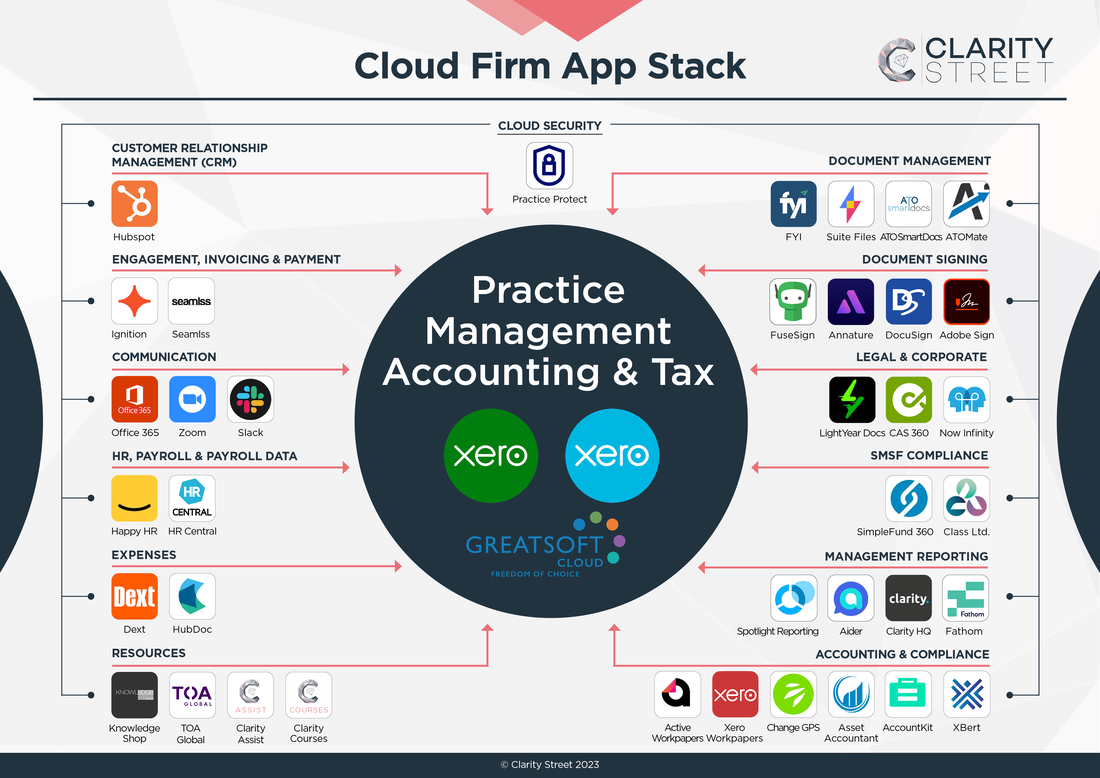

Recognising the need for connectivity between traditional legacy and newer online systems, bluesheets was designed as an end-to-end workflow automation solution. At Clarity Street, we strive for a best practice approach to practice, and as such, we do our best to keep up to date with all of the latest applications, adjusting our App Stack accordingly.

Our latest App Stack comes with a new addition that can help improve the operations and effectiveness of your practice. More details below! Have you ever found yourself working for free, even though you know you should be charging for your services? It's a common issue that many accountants and bookkeepers face, and it can have hidden costs that we may not even realise.

As business owners, we often struggle with the balance between being generous and over-delivering. We want to help people, and we want to build our businesses, but we also have a finite amount of time and energy. This is where the topic of working for free comes in. More than a decade ago, Xero acquired WorkflowMax (WFM) to expand its practice tool offering and help accountants and bookkeepers run their practice seamlessly in the cloud. The launch of Xero Practice Manager (XPM) further realised Xero's early vision for WFM, eventually resulting in two independent products that required individual investments and focus.

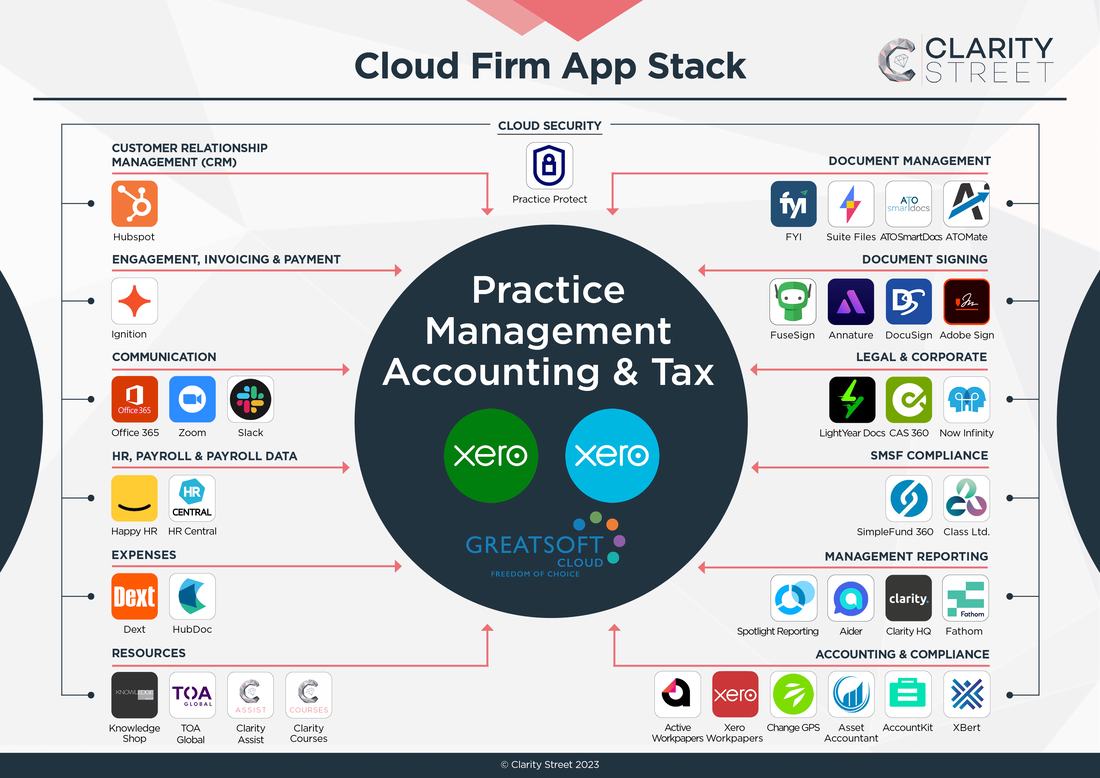

However, Xero's current focus is on its XPM strategy, and it has become evident that WFM needs significant investment to meet the evolving expectations of customers. As a result, Xero has made the difficult decision to retire WFM on June 26, 2024. New WFM trials can no longer be initiated, and the product will no longer be available beyond the retirement date. Despite wanting to invest in WFM and offer new features, Xero has decided to prioritise its efforts as a business to meet customer needs. At Clarity Street, we strive for a best practice approach to practice, and as such, we do our best to keep up to date with all of the latest applications, adjusting our App Stack accordingly.

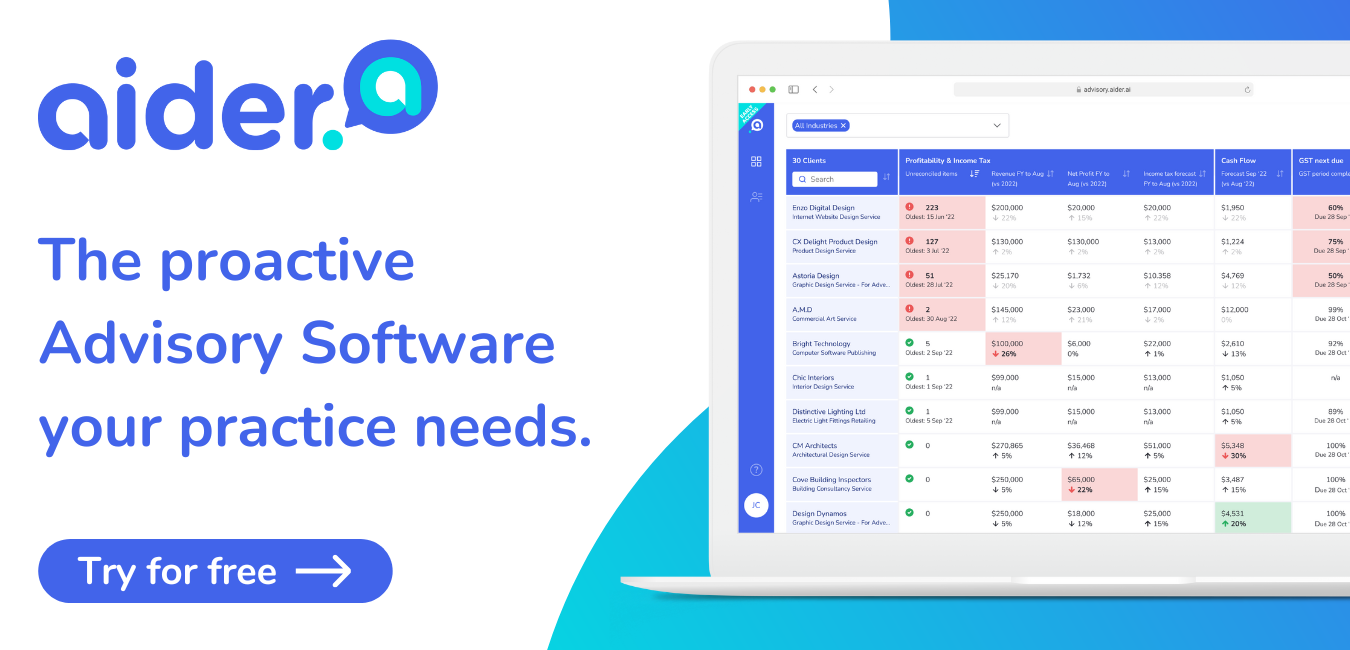

Our latest App Stack comes with a few new additions that can help improve the operations and effectiveness of your practice. More details below! The team at Aider know all too well just how time-consuming and tedious some accounting tasks can be – they know that accountants have the expertise to go the extra mile for their clients, they just don’t always have the time.

Aider is designed to help accountants do more than just accounting – with streamlined automation, Aider does the nitty gritty work for accountants, saving them invaluable time which they can refocus on upselling advisory services. |

AuthorClarity Street was conceived from years of engaging with Accounting firms on a daily basis and a constant desire to make Accounting firms & SME’s more efficient and profitable. Archives

July 2024

|

RSS Feed

RSS Feed