|

Before the idea of BAS Ready was born, there was a simple frustration that every time the quarterly BAS for clients were due, it was impossible to know which Xero client accounts were up to date and which were a mess.

Only a few clients would let you know when they had their accounts up to date, and the rest would think you magically knew when it was ready to go. It was taking more time to chase clients to get their accounts up to date than it was to complete the work. The team at BAS Ready decided to find a way to relieve this pain point, with a focus on making it as simple and stress free as possible to use. Running a business comes with its fair share of challenges, from reducing overhead costs, streamlining systems and processes, to hiring the right people. Fortunately, there is a strategic solution to address these head-on: offshoring.

Finlert have released an exciting new app in the accounting space that allows you to keep Stripe invoices in sync with Xero to give you more accuracy, save you hours per week and avoid mistakes! SubSync by Finlert is here to help you focus less on manual errors, and more on core business and management!

In this blog post, we go through a SubSync customer case study, and how using this app has completely changed their business. At Clarity Street, we strive for a best practice approach to practice, and as such, we do our best to keep up to date with all of the latest applications, adjusting our App Stack accordingly.

Our latest App Stack comes with some very exciting additions that will revolutionise practice management in your accounting firm. We’ve also added a new section for Firm Metrics & Internal Reporting, as we recognise there is a need for better visibility over internal reporting metrics. More details below! The accounting and bookkeeping world is becoming inundated with applications. Maintaining the correct balance within your app stack is a constant battle for firms. There is a constant pursuit for solutions that streamline processes, enhance productivity, and ultimately make life easier, without breaking the bank.

The team at Hero Blue, however, feel there is one area of accounting that is still being completed mostly manually, off the cloud, and after the fact, poorly. And the team at Hero Blue are here to fix that! Over the last few years, we've had a number of wonderful industry contacts, clients and advisors tell us about their favourite personal and professional books... Books they have recommended that Clarity Street should read in order to develop our skills!

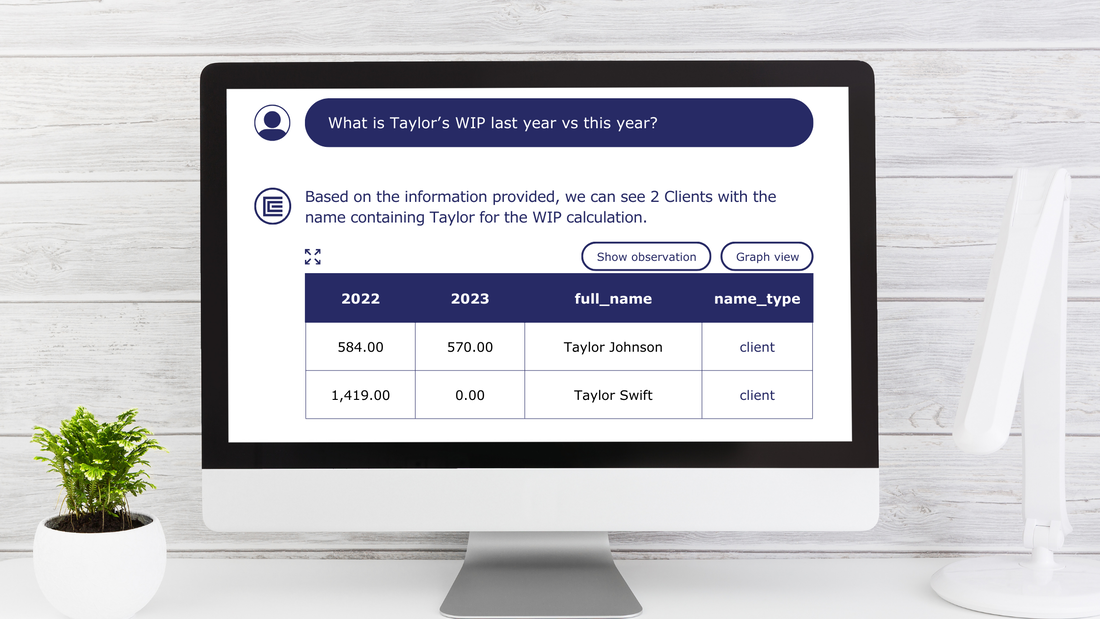

The list is varied and wonderful... oldies and new books. Full of professional, business and personal development topics - areas we all need improvement in. Etani is excited to announce a game-changer for accounting firms: the integration of EVA with Xero Practice Manager (XPM). This innovation is reshaping our approach to day-to-day reporting.

By utilising conversational queries, EVA delivers both high-level and granular data insights instantly, on demand. The modern accountant's role has never been more multifaceted, and with the introduction of the new TPB regulations, the role has received yet another layer of complexity.

As per the TPB Practice Note (TPBPN 5/2022), there's an increasing demand for accountants to verify the identity of their clients. While this measure intends to promote accountability and deter fraudulent activities, it is undeniably introducing a slew of challenges for professionals in the industry. Want your staff to have more time to focus on providing value-add services to clients? More time to be able to progress ATO statement reconciliations (GST, Wages etc) even when the ATO Portal is down? And less time on monotonous data entry work and minimise errors?

Well, Atosa might be for you! In today's fast-paced digital economy, businesses and tax professionals are constantly looking for ways to streamline their processes, reduce costs, and stay compliant with the ever-changing regulatory landscape.

One such innovation that's been gaining traction in recent years is eInvoicing. The Australian Taxation Office (ATO) has recognised the potential of eInvoicing and has been working closely with software developers to implement this technology across various industries. In this blog, we'll explore what eInvoicing is, its benefits, and how the ATO is supporting its adoption in Australia. |

AuthorClarity Street was conceived from years of engaging with Accounting firms on a daily basis and a constant desire to make Accounting firms & SME’s more efficient and profitable. Archives

July 2024

|

RSS Feed

RSS Feed