|

The modern accountant's role has never been more multifaceted, and with the introduction of the new TPB regulations, the role has received yet another layer of complexity. As per the TPB Practice Note (TPBPN 5/2022), there's an increasing demand for accountants to verify the identity of their clients. While this measure intends to promote accountability and deter fraudulent activities, it is undeniably introducing a slew of challenges for professionals in the industry. 1. The Manual Effort of Individual Checks The predominant issue lies in the time and effort required to manually complete and track the status of individual identity checks. Unlike automated processes, which provide real-time updates and notifications, manual checks require accountants to invest valuable time in follow-ups, particularly with clients who do not complete the verification process timely. 2. Trust & Time Consumption Introducing a client to a video call or implementing this check in a pre-established meeting has its set of hurdles. Time – an asset every professional values – is consumed not just in the setup but in explaining and reiterating the need for such checks. The need to continually remind and train staff, especially senior directors, adds another layer to this time-intensive process. 3. The Awkwardness Quotient It's no secret that asking for personal identification is not the most comfortable conversation to have. Repeatedly explaining the reason behind this requirement can strain the trust-based relationship between accountants and their clients. 4. The Privacy Paradox In an age of increasing cyber threats, clients are more protective of their personal data than ever before. Many are hesitant to share ID documents electronically, given the risk of leaving digital footprints in email and on servers vulnerable to breaches. Accountants, too, are wary of storing these documents due to the potential liabilities. 5. Software Solutions: A Double-edged Sword While software solutions might seem like the answer, they often* come with their own set of problems. These platforms often require manual data entry, increasing the potential for human error. Additionally, the surge in data breaches globally makes it uncertain if the ID documents belong to the client in question. This uncertainty, in turn, leads to additional verification processes, creating more friction during client onboarding. * for an integrated software approach, read to the end! Looking Ahead: Tranche 2 As if the current challenges aren't enough, the looming "tranche 2" regulations, as outlined by Chartered Accountants ANZ, will necessitate even more checks. These new checks are likely to include PEP (Politically Exposed Persons), Sanctions, and Adverse Media screening. This new layer, coupled with the existing manual processes, suggests that accountants will have to grapple with even more complexities in the near future. While the new TPB regulations are crafted with the best intentions, the practical implications are far from straightforward. Accountants, in their quest to remain compliant, are walking a tightrope – balancing regulatory demands with the need for efficient and trust-based client interactions. The industry awaits streamlined solutions that can merge compliance with convenience. Streamlining Identity Verification with IdentityCheck The digital transformation wave demands efficient and precise tools. Integrated software, like IdentityCheck, rises to this challenge, offering a suite of unparalleled benefits:

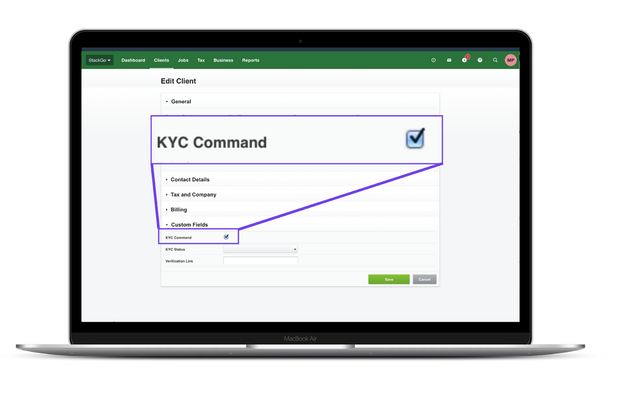

Crafted by StackGo, leaders in integrated product innovation, IdentityCheck is a game-changer for Accountants navigating the world of identity verification.

We invite you to explore more by watching their demo video, trying their solution at no cost, or diving deep with a live demo. Step into the next generation of streamlined identity verification. If you'd like to find out more about how IdentityCheck could benefit your accounting firm, and work within your current App Stack, get in touch with us, or book a meeting here. © Clarity Street 2023 Comments are closed.

|

AuthorClarity Street was conceived from years of engaging with Accounting firms on a daily basis and a constant desire to make Accounting firms & SME’s more efficient and profitable. Archives

July 2024

|

RSS Feed

RSS Feed