|

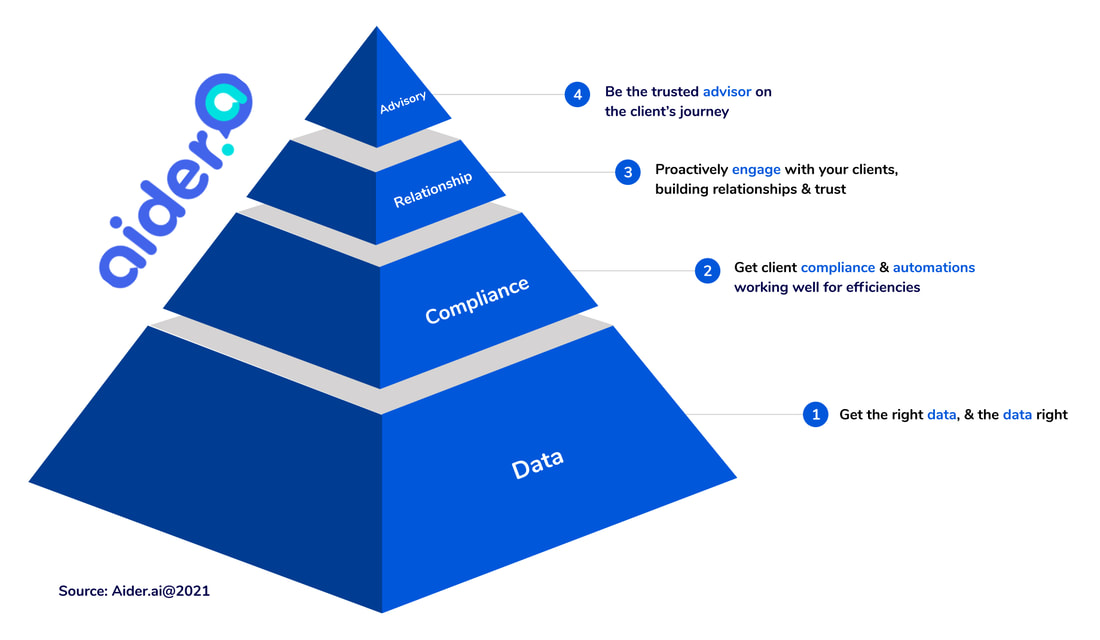

Clarity Street is proud to bring this article to you by Aider. Aider is building an engagement platform for advisory that gives you access to all your small business clients' data and helps you build more meaningful relationships at scale. Engagement has two meanings for an accountant. The first one is the more formal. Every accountant has to have an official contract with their client—an engagement letter. The other meaning of engagement is just as important, and it's the crucial element for every practice looking to scale and better serve their clients. The second meaning of engagement relates to building relationships with your clients that are long-term and sustainable. This engagement is the true future of advisory because it's about consistently adding value to your clients' businesses by being more proactive and relational. More and more clients tell us that while their accountants think of themselves as advisors, they don't see their accountants that way. They feel that their accountant doesn't understand their business and always has their eyes on the rear-view mirror. Small business clients are telling us all the time, "if you don't know my business, how can you be my advisor?" To think more about how engagement helps you provide true advisory to your clients, we like to adapt Maslow's hierarchy of needs to explain. All of these elements are necessary to be your clients' trusted advisor.

The first thing an engagement-focused advisor does is to get the right data and to get the data right. Make sure that all of your clients have their data in good condition so you have accurate information to work from. Onboarding your entire client base to Xero is a good start to getting client data to work for you. Accurate data has to be the foundation of everything you do for your clients. The next step is to set up a more efficient system through automations, workflows and efficiencies. Offering advisory at scale is nearly impossible when you're bogged down with manual processes, like chasing up a client over the phone to remind them about GST or emailing people about how much they have to set aside for tax. These reactive processes take a lot of time, but they don't really add value to your clients. You have to ask yourself, "how can I automate these processes in my firm?" Automations, workflows and efficiencies will help highlight which clients need the most attention. So, now you can access accurate data and you're automating your processes and workflows to be more efficient. Good. These foundations enable more frequent, more valuable and more proactive engagements with your client. With data and efficiencies in place, you can use technology to share the right information with your clients so you are in touch with them before there is a problem. Being a proactive accountant means you see what's on the horizon, not just last month's problems. Relationships are built on engagement, and engagement adds value, engagement helps your clients grow their businesses, engagement helps you scale. Congratulations! You've now climbed to the top of the pyramid. When you have data, efficiencies, and an engaged client base, you've built the relationships that mean your clients will give you the permission to be their advisor. A true advisor is someone who understands their clients' businesses and can lead them into the future by telling them what's coming next. You'll have regular checkpoints that help alleviate stress come tax time and give hints which businesses’s cash flow needs the most attention. Most importantly, you won't be the only one who sees you as an advisor; your clients will too. Clarity Street is excited to see the future of Advisory and excited to see what Aider is developing! They are still in the beta stage, but if you would like to be among the first to be informed when they launch, please register your interest here or book a demo to see how Aider can help you scale your business. Comments are closed.

|

AuthorClarity Street was conceived from years of engaging with Accounting firms on a daily basis and a constant desire to make Accounting firms & SME’s more efficient and profitable. Archives

July 2024

|

RSS Feed

RSS Feed