|

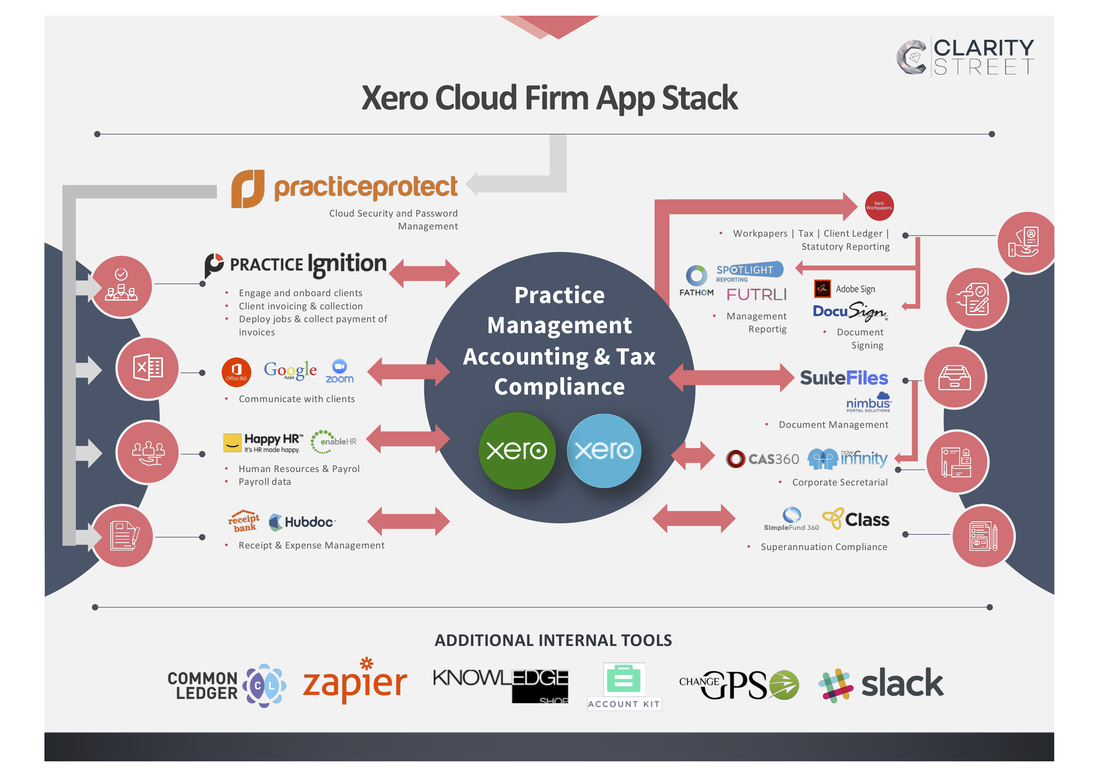

Last week we discussed the core applications of our App Stack which we think are vital to the operation of a cloud based accounting firm. This week we discuss the compliance and reporting applications that help you as the trusted advisor, to produce both your compliance and business reporting advisory work. Xero Tax Xero Tax is an Australian and New Zealand tax and reporting application. It allows the accountant to work seamlessly on your clients tax and compliance work from anywhere in the world. It integrates with Xero (Blue) and Xero Financials which allows the accountant to map some of the more easily categorised income and expense items to the correct labels in the Income Tax Return. If you are using Xero (Blue) to produce your clients BAS’s you are also able to integrate the BAS labels directly into the BAS form in Tax. One thing to note though is that when using the simplified BAS in Xero and importing into Xero Tax, you will NOT be able to use the GST reconciliation report to its fully automated potential, due to the reporting platform differences. Individual clients are able to have their ATO prefilling report automatically imported into the return, avoiding manual entry and any chance of human error. Xero Tax is built with integration in mind and is slowly starting to be decoupled from the Xero app stack allowing for integration with other 3rd party practice management suites, that may not necessarily have any or a robust tax application. It’s true that Xero Tax isn’t as robust as some of its desktop competitors are in regards to its schedules, or with supporting the completion of any returns pre 2014, but it does EVERYTHING that an accountant needs for 99% of your lodgement requirements. Anything that falls outside of this, there’s always a workaround. The key features that Xero Tax takes care of are:

Xero Workpapers Xero workpapers consolidates your old excel spreadsheet or paper based workpaper filing system into an intuitive easy to use workpaper pack. It syncs seamlessly with Xero (Blue) and pulls accurate data into the appropriate workpaper saving time and manual handling. The platform allows for most file types to be saved to a general ledger line item within the workpaper and previewed on screen, although there is some delay for larger files. If a general ledger account is updated in Xero (Blue), with the press of a sync button the workpaper is updated to the latest figures. Client queries can be produced and sent to the client via the workpapers app, allowing the client to log into a client portal containing all the queries raised and giving them the ability to quickly respond or leave a query until they are able to find the correct information. Reviewing a file is as simple as clicking a tick button when a workpaper is correct, or if there is a review point a query can be generated against the workpaper. Xero Workpapers is great for entities, but doesn’t handle individuals, so keep that in mind! Here’s some of its key features:

With reference to one of our past blogs Software on its own is not business advisory, it’s important to note that that once you are in a position to provide higher level business advisory services, there are three great pieces of software out there in the marketplace (Spotlight, Fathom, Futrili) that can easily compliment your client’s needs...and make you look like a kick ass advisor! Each one has its own pros and cons, or probably a better way to state this, is that they are suited for different clients, depending on their needs. This is why Clarity Street remains agnostic in our preference, because it’s up to the accountant and their level of understanding and therefore ability to produce, interpret and then present the information in the reports. Also, it’s really up to your client and what you are trying to achieve for them.

Ultimately, a picture tells a 1000 words as they say and most clients understand and interpret a visual representation of their business, better than straight up figures in a Balance Sheet or a P&L, so being able to quickly provide these reports in line with scheduled meetings to present the information, provides the trusted advisor with an edge and a talking point to help your clients succeed. Understand what information/benchmarks/kpi’s your clients will find valuable, try each application out and see what will be a better fit both from a usability perspective internally and presentation for the client. Next week we take a look at the apps that compliment the final part of the accountants compliance program, superannuation and corporate secretarial. If you want to know more, get in touch with us! Comments are closed.

|

AuthorClarity Street was conceived from years of engaging with Accounting firms on a daily basis and a constant desire to make Accounting firms & SME’s more efficient and profitable. Archives

July 2024

|

RSS Feed

RSS Feed