|

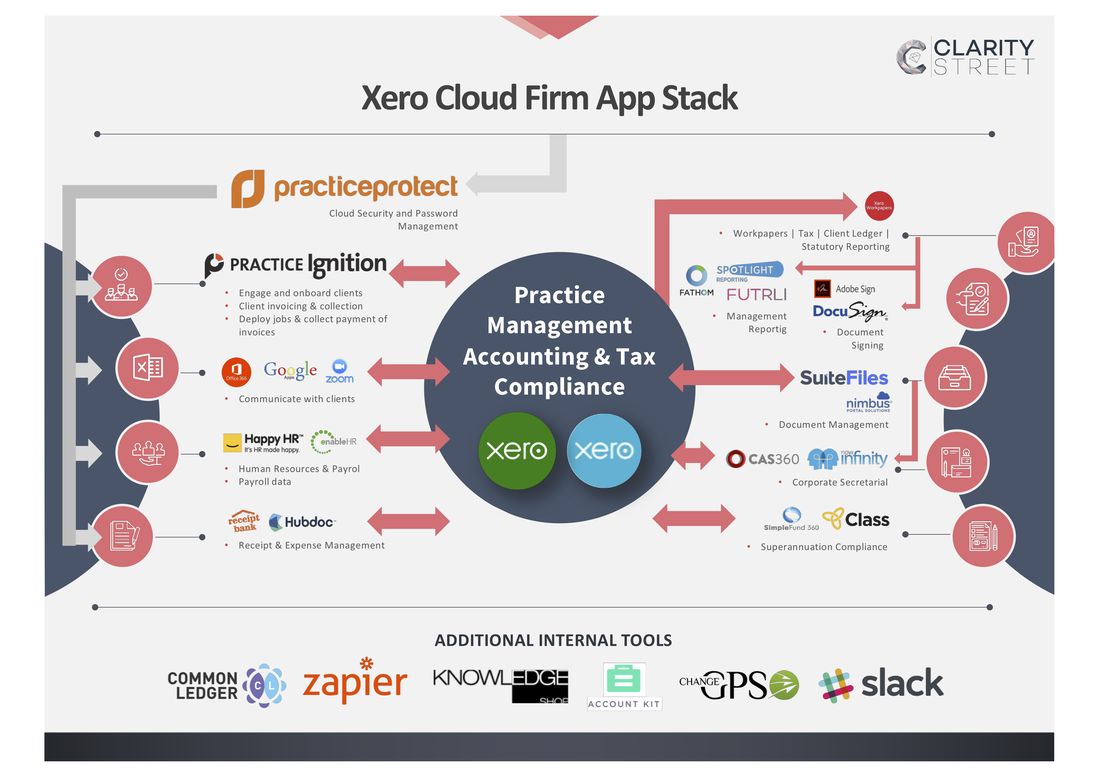

Welcome to 2019 and we trust that all our followers and readers had a superb break and if you’re back at work now, that you’re pumped for an exciting year ahead! Before the break and in our previous blogs, we discussed the core applications and Reporting Applications of our App Stack which we think are vital to the operation of a cloud based accounting firm. This week we discuss the additional compliance applications that help you as the trusted advisor around corporate affairs and self managed superannuation funds. Corporate Affairs

BGL CAS 360 and Now Infinity One of the hardest things to manage when it comes to Corporate Affairs is actually your clients, as in, getting them to understand the importance of being on top of documents being signed and lodged, and then their ASIC fees being paid on time...to avoid the fines! In order to manage the corporate affairs of your clients as efficiently and effectively as possible we recommend using a corporate affairs application such as BGL CAS 360 or Now Infinity. Both of these applications seamlessly interact with our app stack including Xero Practice Manager (XPM) with synchronisation between them, ie when a directors details are changed you have the ability to update inside of XPM. The advantage of this is that your databases are no longer silos of information and when a change is made in one, it updates the other saving manual labour and time! Both systems allow for the automation of annual returns, company registrations, company debt alerts, seamless document delivery, digital signing and an integration with Xero. BGL and all their products have been long time players in this market and are well established in providing market leading software. NowInfinity are much newer to this space and have different payment plans that could potentially lend to being more cost effective depending on the size of your firm. Which one you choose, will come down to the user interface and how you like the look and feel of the software, along with how savvy your corporate compliance department is. In our experience this is one department in firms that is massively over looked in terms of generating revenue and ensuring your staff are correctly skilled. In the coming weeks we’ll talk more on this particular topic, but if you would like to know more about how you can improve this department, contact us, or contact our good friends at Foster Town who specialise in all things Corporate! Superannuation Compliance BGL Simplefund 360 and Class Super With the inception of Self Managed Superannuation Funds (SMSF) at the end of the last century, so came the versions of software to manage and complete the tax components of the compliance requirements for the ATO. BGL and Class Super have been long standing players, for BGL first with their desktop variety of SimpleFund and now they have caught up to Class Super and offer a cloud based solution with SimpleFund360. Both software options will allow for the administration and completion of all elements relating to the management and compliance aspects of your client’s SMSF. Both of them have live data feeds from a number of institutions and both connect into Xero Practice Manager to ensure your database is in sync. Like the Corporate side of things, your choice between the two products will come down to the user interface and price. Whilst Class Super is the first “cloud” SMSF software application, BGL and it’s Simple Fund products (both desktop and now cloud) have been in the market for longer. Our advice, get a trial with both if you are new to the market and make a decision as to what suits your business better because in our opinion, both products are superior in their own ways. Next week we take a look at the apps that help accountants create, store and collaborate both internally and with your clients. If you want to know more, get in touch with us! Comments are closed.

|

AuthorClarity Street was conceived from years of engaging with Accounting firms on a daily basis and a constant desire to make Accounting firms & SME’s more efficient and profitable. Archives

July 2024

|

RSS Feed

RSS Feed